What You Need to Know About Flexible Spending Account (FSA) Limits in 2026

What You Need to Know About Flexible Spending Account Limits in 2026

At a Glance: Flexible Spending Accounts (FSAs) allow employees to set aside pre-tax dollars for qualified healthcare and dependent care expenses, reducing taxable income and overall tax liability. For 2026, the healthcare FSA contribution limit is $3,400, the dependent care FSA limit is $7,500 per household, and the maximum carryover amount is $680.

Healthcare costs continue to rise, and for many employees, every tax-advantaged benefit matters more than ever. Flexible Spending Accounts (FSA) are one of the most effective ways to manage healthcare and dependent care expenses while reducing your taxable income. By contributing pre-tax dollars, employees can stretch their healthcare budgets further and keep more of their paychecks.

Each year, the

Internal Revenue Service (IRS) sets contribution limits for FSA. These limits can change based on inflation and regulatory updates. Understanding the 2026 FSA limits is important for any individual or business trying to make the most of their benefits and avoid leaving money on the table.

Understanding FSA Basics

What Is a Flexible Spending Account?

A Flexible Spending Account (FSA) is an employer-sponsored benefit that allows employees to set aside pre-tax money to pay for qualified healthcare or dependent care expenses. Because contributions are deducted from your paycheck before taxes, FSAs reduce your taxable income and lower the amount you pay in federal income tax, Social Security, and Medicare taxes.

FSAs typically operate under a “use-it-or-lose-it” rule, meaning unused funds may be forfeited at the end of the plan year unless your employer offers a grace period or carryover option.

Who Can Participate?

FSAs are available only if your employer offers them as part of its benefits package. Enrollment usually happens during the open enrollment period. Once you choose your contribution amount, it is generally locked in for the year unless you experience a qualifying life event, such as marriage, birth of a child, or job change.

Unlike

Health Savings Accounts, FSAs have no income limits, making them accessible to a wide range of employees.

Key Benefits of FSAs

FSAs offer immediate tax savings, access to your full annual election from the first day of the plan year, and coverage for a wide range of common healthcare and dependent care expenses. For many households, they are a core part of smart benefits planning.

Types of FSAs Explained

Healthcare FSA

A Health Care FSA (HCFSA) covers medical, dental, and vision expenses, including co-pays, prescriptions, and many out-of-pocket costs. These accounts cannot be paired with HSAs.

The 2026 Health Care FSA contribution limit is $3,400. The IRS adjusts these limits annually to account for inflation and rising medical costs. This limit applies per employee, not per household. If both spouses have access to an FSA through their employers, each can contribute up to the full individual limit.

Dependent Care FSA Limits for 2026

A Dependent Care FSA (DCFSA) covers childcare and adult dependent care expenses that allow you and your spouse to work or look for work. Eligible dependents generally include children under age 13 or adults who cannot care for themselves. Covered expenses include daycare, preschool, and after-school care. For 2026, the limits increased:

- $7,500 per household for single filers or married couples filing jointly

- $3,400 for married individuals filing separately

Unlike healthcare FSAs, these limits are not indexed for inflation and apply per household, not per employee.

Limited Purpose FSA Limits

A Limited Purpose FSA (LPFSA) is limited to dental and vision expenses and is designed for employees enrolled in HSA-qualified health plans. These plans allow families to manage predictable dental and vision costs separately while preserving HSA eligibility.

LPFSAs share the same contribution limit as healthcare FSAs, so the 2026 limit is $3,400.

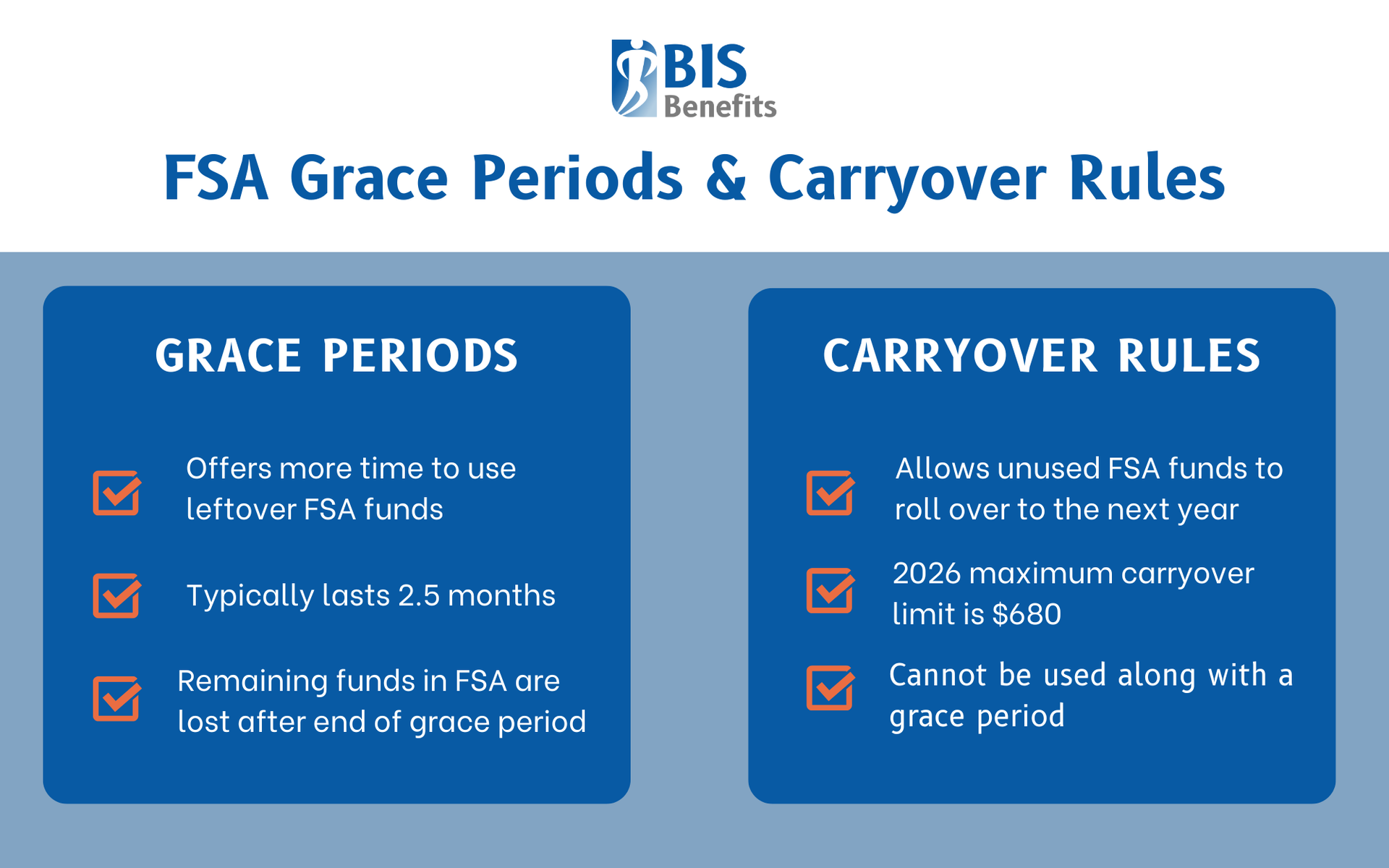

Grace Periods and Carryover Rules

Traditionally, unused FSA funds are forfeited at the end of the plan year. This rule exists to prevent tax abuse but requires careful planning.

Grace Period Option

Some employers offer a grace period of up to 2.5 months after the plan year ends, allowing employees to incur expenses and use remaining funds.

Carryover Limits

For 2026, the maximum carryover amount for a healthcare FSA is $680. This amount rolls over automatically if offered by your employer. Plans cannot offer both a grace period and a carryover.

Employer Plan Variations

Always review your specific plan details, including claim submission deadlines and whether your plan follows a calendar year.

Eligible and Ineligible FSA Expenses

IRS Publications 502 and 503, FSA administrator apps, and employer benefits portals are reliable resources to verify eligibility.

Common Eligible Healthcare Expenses

Eligible expenses include prescriptions, doctor visits, dental care, vision exams, glasses, contact lenses, medical supplies, first aid items, and FDA-approved over-the-counter medications.

Common Ineligible Expenses

Cosmetic procedures, insurance premiums, general vitamins, gym memberships without a prescription, and overnight camps are typically not eligible medical expenses.

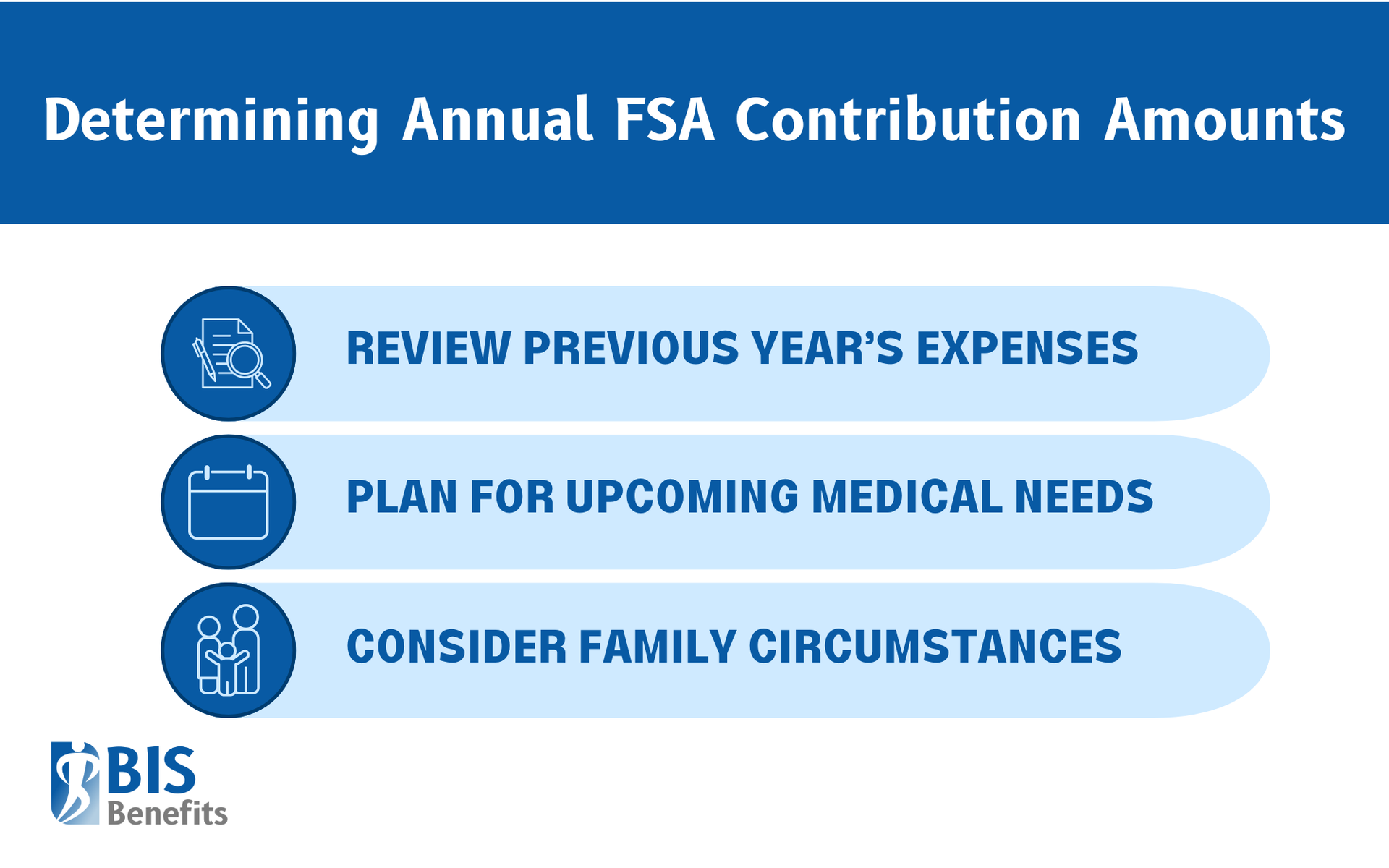

How to Determine FSA Contribution Amounts

Review Last Year’s Expenses

Start by reviewing your prior year’s healthcare or dependent care spending. Look for predictable expenses such as prescriptions, routine doctor visits, therapy sessions, or contact lenses. Past claims data from your insurer can be helpful.

Anticipate Upcoming Needs

Consider planned procedures, scheduled surgeries, or expected changes in prescriptions. Families expecting a baby or supporting aging parents may see increased dependent care or medical costs.

Factor in Family Circumstances

Contributions should reflect your household situation, including the number of dependents, chronic conditions, and your spouse’s healthcare needs. Life changes during the year can affect spending patterns.

Use Planning Tools

FSA calculators, employer tools, and benefits administrators can help estimate an appropriate contribution amount.

Strategies for Maximizing FSAs

- Schedule predictable appointments early

- Purchase eligible items before the year's end

- Review balances regularly

- Use FSA debit cards carefully and save receipts.

- Coordinate FSA planning with other tax benefits like HSAs or dependent care tax credits

- Avoid common mistakes like over-contributing, missing enrollment deadlines, failing to track balances, or using funds for ineligible medical expenses

What Business Owners Need to Know About 2026 FSA Account Limits

FSAs are employer-sponsored benefits, which means business owners control whether they’re offered, how they’re structured, and which features are included, such as carryovers or grace periods. As annual maximum amount limits increase, offering an FSA can become even more valuable as a low-cost benefit that helps employees manage rising healthcare expenses while also reducing payroll tax liability for the business.

Employer contributions are not required, but even employee-only funded FSAs can deliver meaningful tax savings through

reduced Federal Insurance Contributions Act (FICA) taxes. A well-structured FSA can support employee retention, improve benefit satisfaction, and provide tax advantages without significantly increasing benefit costs.

Find Group Benefits Solutions for FSA Account & More with BIS Benefits

Proper FSA planning turns everyday healthcare expenses into meaningful tax savings. By reviewing eligible expenses, knowing your employer’s rules, and choosing a contribution amount that fits your needs, you can maximize savings and reduce out-of-pocket costs.

At BIS Benefits, we specialize in helping Georgia-based businesses navigate

group benefits and

commercial insurance. Our experienced insurance brokers understand industry-specific risks and the regulations for programs like

Flexible Spending Accounts and

Health Savings Accounts.

If your company has at least 15 employees,

Request a Quote today to find out how BIS Benefits can help you find the group benefits or business insurance solution.